Experts discuss the Zimbabwe economy in the "new colona evil"

On September 8, the British Royal International Research Institute (Chatam House) held the Corona Village and the subsequent Zimbabweed Economics.In Zimbabwe, the former President Robert Mugabe, who had grasped the administration for 37 years in 2017, was losing, and President Emerson Mnangaguwa, who was supported by the army, was appointed (see the article on September 30, 2019).However, the economic reform that the president has been raising since the inauguration of the president has not progressed due to severe foreign currency shortage and inflation, and lock -down from the end of March 2020 due to the expansion of the new colon virus infection, resulting in further deterioration of the economy.There are concerns (as of September 13, the total domestic infected person is 7,508).Under such circumstances, experts in the Zimbabwe economy gathered and a webinar was held with the prospect of the economy.

Secretary of the Gimbab Estate Development Agency (ZIDA), who was on stage, explained that there are many issues due to the expansion of the new colonovirus infection, but it can be an opportunity to create new business opportunities.In particular, Zimbabwe has a mobile phone and Internet penetration rate of more than 50 % as a developing country, so it has a technically suitable company to bring more business opportunities.On the other hand, overseas donors and investors have shown that they have a strong image of corruption to Zimbabwe, and even in the case of new colonovirus measures and support, corruption and fraud management were suspected., Signed the need for reform.

Karen Pindiriri, a senior lecturer at the Faculty of Economics, Jimbabue, who next stage, assumed that the unstable exchange rate (Note) affects the domestic monetary supply, and the Jimbabwe government has to stabilize the exchange rate.He pointed out that it is necessary to take a cautious monetary policy, including the independence of the central bank, and to manage strict fiscal management based on the lessons of the past hyperinflation.

According to a report on July 8 at the South African International Studies Research Institute (SAIIA), the fuel that relied on imports soared, especially in August 2019, due to unstable foreign exchange and shortage of foreign currency after the change of government.It is said that it has exceeded 300 %.In October of the same year, the government has taken measures such as suspension of domestic mobile money services at one time due to the need for cash distribution, and the country's macro economic environment is still unstable.Is shown.

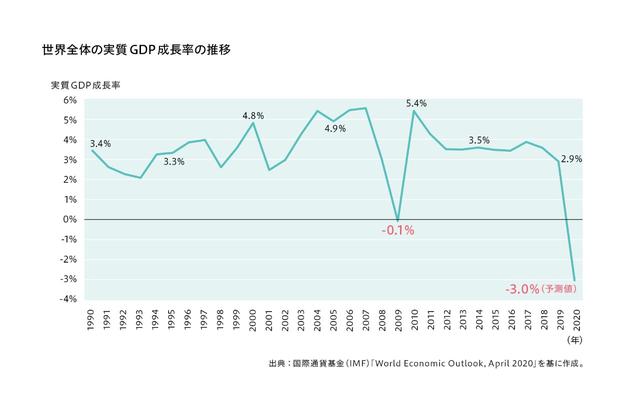

IMF was in June 2020, and Zimbabwe's economic growth rate in 2020 is minus 10..He showed a 4 % prospect.It is expected to be the second lowest in the country's definition of Subsahara Africa, which is second only to Seishel and Mauritius in 45 countries.

(Note) Zimbabwe temporarily used US dollars as a real currency, but Zimbabwe Central Bank designated the provisional currency RTGS dollar in June 2019 as the only legal currency.Due to the weakness of the financial and financial infrastructure, the RTGS dollar continues to fall and is a factor in an increase in inflation.

(Hitoshi Takahashi)