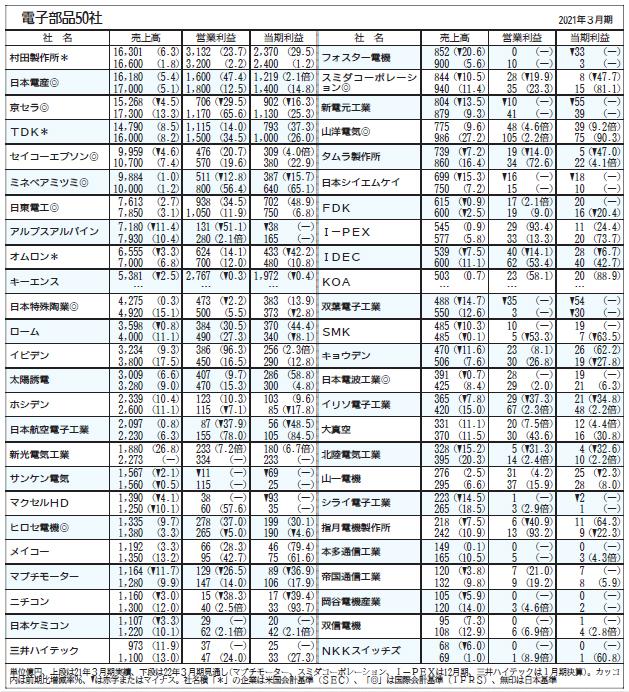

45 out of 48 electronic components are expected to increase operating profits for the current term.Voices of "IT bubble exceeded" | New Switch by Nikkan Kogyo Shimbun

Major companies, over 20 % operating income

Electronic component manufacturers are likely to continue to recover from Corona's evils this term.The financial results of 50 listed companies in the field of electronic components are expected to exceed 45 companies in 48 companies, which have announced consolidated achievement forecasts in the fiscal year ending March 202, 2022.The average profit increase is 20 % or more.Expecting a sudden decline in demand in demand, mainly in the second half, it will remain temporarily, and multiple companies aim to renew the maximum profit.Whether you can maintain your growth after the next fiscal year, the management decisions for the current term, such as identifying the market that extends after the corona, the size of production and development investment, and timing.(Kuniwa Yamada)

Smartphone / car, condenser demand

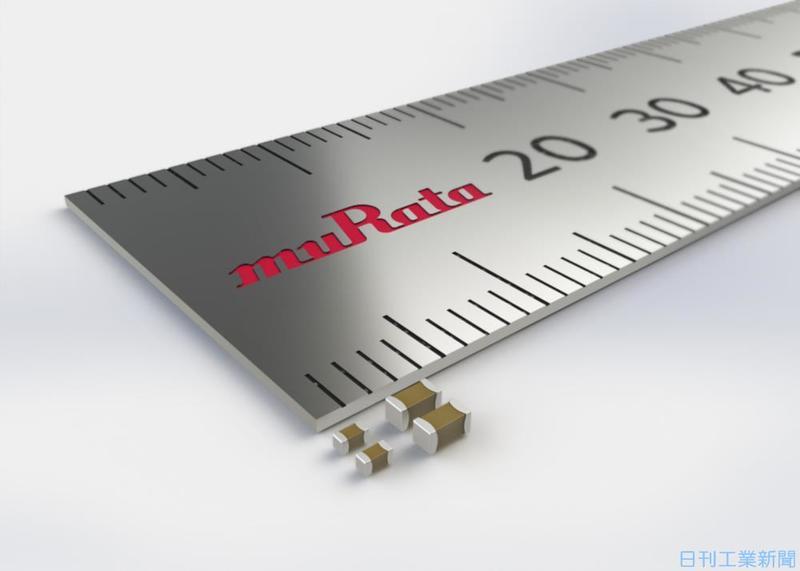

In the fiscal year ending March 2010, Murata Seisakusho and Nippon, TDK, Minebea Mitsumi, Taiyo Toten, Meiko, and Yamoyo Electric will be renewed a record profit.Murata Seisakusho, TDK, and Taiyo Den will be updated for the second consecutive term.In the fiscal year ending March 2010, TDK President Shigemitsu Ishiguro said, "The risk of corona is remaining, but cars and smartphones (smartphones) are expected to maintain positive compared to the previous term."

Many electronic component manufacturers have recovered from the second half of the previous term, and the vigorous state continues.The main electronic components, a condenser, a BB ratio in January -March (a value of the 3 -month -a -month order by sales), about 1.4, about 1.3 in the Murata Manufacturing Office."It is higher than the IT bubble in the early 2000s," said Daiwa Securities Takumi Sado Chief Analyst.

According to a private investigation, a smartphone, which has about 1,000 laminated ceramic capacitors (MLCC), is expected to increase by about 9 % from the previous year, 1,360 million units of smartphones.It is expected that 85 million vehicles use 3000-8000 MLCCs per unit will be 85 million units (up 11 % year -on -year).According to Murata Seisakusho, President Nakajima, "Automobile is accumulating inventory for recovering production, and mobile phones are increasing the production of smartphone makers in Greater China to expand their market share."

Some consumers cannot produce as they want due to lack of semiconductors.Nevertheless, Sado says, "As the semiconductor supply and demand (pan) continued, Sado may have increased the level of" appropriate stock "."Industry officials say, "This situation will last at least during the first half."

On the other hand, there is a person who predicts the recovery in demand in the future, and five companies, including Murata Seisakusho, are expected to fall below the same period of the previous year.However, executives of Murata Seisakusho emphasize the difference from 17 to 18 years, which was difficult to grasp the size of the city inventory, stating that "the second half is adjusted but the location of the stock is visible."Sado analyzes, "The impact will be within the scope of the company, and many companies will be able to secure more profits during the full year."

Increased production of storage batteries and advanced operation

For many electronic component manufacturers, the true critical field is likely to be after the fiscal year ending March 2010.Of the 45 companies expecting to increase operating profits this term, only 21 companies will maintain or surpass operating income right before the Corona (fiscal year ending March 2018 or March 2007).

Looking at the results of electronic components from the peak before the Lehman Shock to the fiscal year ending March 19, 19, it is divided into a group that continues to increase average or less than a group of less than a few percent."In the recovery phase of this term, many companies can achieve a lot of profits in both groups," (Mr. Sado), but the difference between the two may be different from the next fiscal year.

It is a growth strategy that will affect the performance after the next term.From the medium -term management plan newly formulated by some companies, it can be said that each company aims for the “appearance after the next fiscal year”.In three years, TDK will invest 45 billion yen, which is equivalent to 60 % of the investment in the energy -applied product business including batteries.President Ishiguro anticipates that "energy transformation (EX) will proceed further and will boost the demand for related passive parts and secondary batteries by changing mobility and shift to regenerative energy."

The medium -sized lithium -ion secondary battery, which is expanding the market for electricity storage systems and electric motorcycles, is said to be "I want to put a focus in the future" (President Ishiguro).

Japan Airlines and Electronics Industries set a goal of 300 billion yen in sales and ordinary income of 30 billion yen in the fiscal year ending March 2016, the final year of the middle fiscal year.Approximately an average annual growth of a camera connector, such as a camera connector for advanced driving support systems (ADAS) and large current and high voltage connectors for electric vehicles (EVs), an average annual growth.

In the mobile device field, the production capacity of the substrate vs. substrate connector will be increased by 60 % year March 2001 during the middle period.President Tsutomu Onohara says, "We aim to grow more than the market, expanding the market while maintaining the position in the mobile phone market and increasing the market."

Nikkan Kogyo Shimbun May 31, 2021